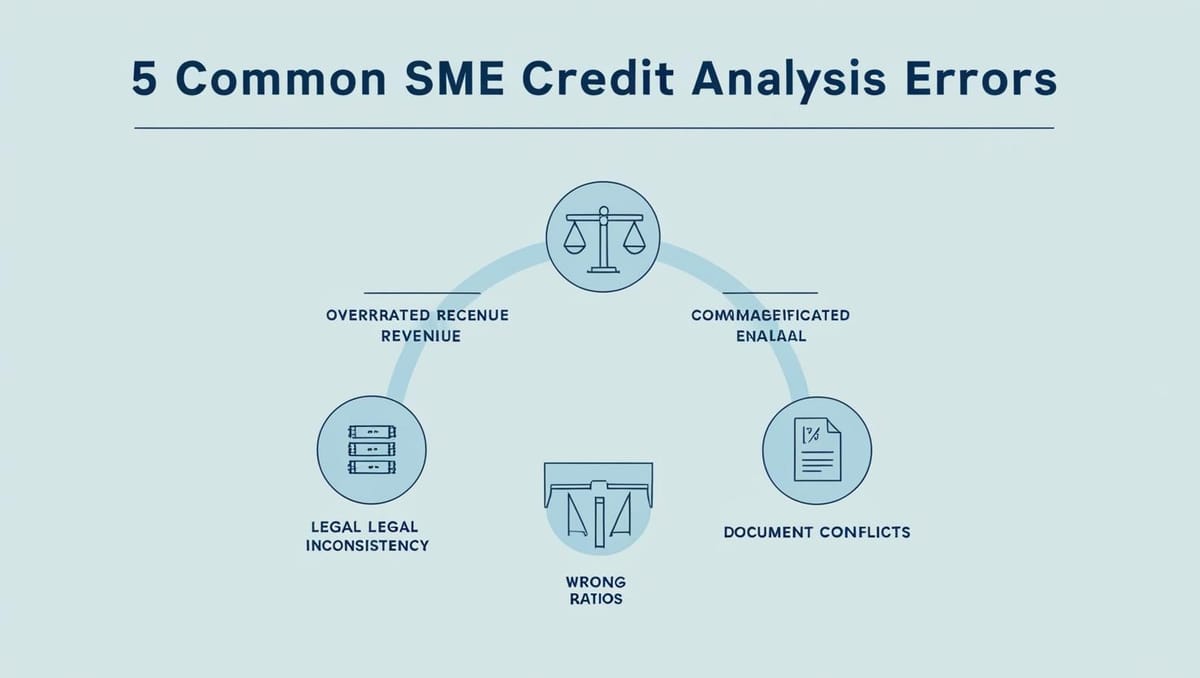

The 5 most common mistakes when analyzing SME financing files

Granting financing to an SME is more than just reading a balance sheet.

Despite the tools available, many analysis errors persist, leading to unjustified refusals... or risky files being accepted.

In this article, discover the 5 most common mistakes, illustrated by case studies, and how to avoid them using decision-support tools like RocketFin.

🧠 Why is SME analysis so complex?

- Financial data sometimes incomplete

- Strong heterogeneity between sectors

- Accounting statements with little information on actual health

- Fast-changing by-laws, management and activities

- Risks related to customer or supplier dependence

This makes manual analysis a high-risk area for error, especially in contexts of rapid growth or scale.

❌ Mistake 1: Overestimating net income or sales

The classic case :

A company posts positive net income and rising sales. A hasty conclusion: "healthy profile".

But we forget to check:

- Net cash position

- Short-term debt

- Seasonality in the sector

- Customer/supplier lead times

📌 A good accounting result can mask liquidity tensions or dependence on a single customer.

💡 Best practice:

Analyze actual cash flow and cash flow from operations rather than net income alone.

❌ Mistake 2: Ignoring weak legal signals

- Recent change of manager not explained

- SIREN deactivated or company dormant

- Address linked to a commercial mailbox

- Statuses contradictory to the real purpose

📉 These weak signals are often precursors of more serious problems (fraud, inactivity, legal instability).

💡 Best practice:

Set up automated verification of SIREN, legal representative and up-to-date articles of association.

❌ Error 3: Apply a single template to all folders

Each sector has its own specific features:

- A construction company has low cash flow but high WCR

- A SaaS with few assets but stable MRR

- A business with a high inventory but a low margin

📌 Applying the same ratios to all these profiles distorts the analysis.

💡 Best practice:

Use a scoring engine contextualized by sector and business model.

❌ Error 4: Failure to detect inter-document inconsistencies

- Sales declared on form ≠ Balance sheet sales

- The manager signed is not the one indicated on the Kbis certificate.

- The stated share capital does not correspond to the articles of association

These are frequent errors in SME files, often due to :

- Documents not updated

- Communication oversights

- Attempts to disguise data

💡 Best practice:

Automate cross-checking of data between sources (PDF, API, form, statuses...).

❌ Error 5: Decide without clear explanation (or traceability)

An analyst rejects a file for "balance sheet doubt"... but nothing is documented.

🔍 This poses a problem:

- In the event of a dispute

- To explain a customer decision

- To feed an AI / machine learning model

💡 Good practice:

Use a system that documents each decision, with the criteria used, date, score, and final status.

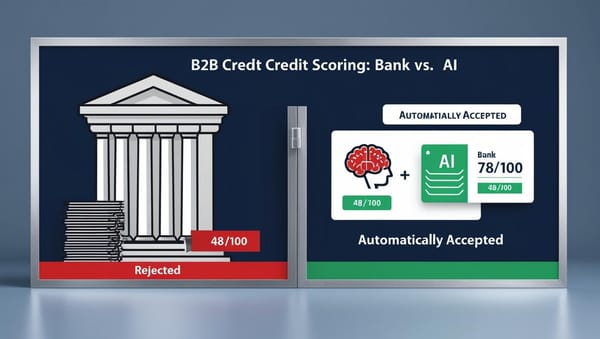

🔧 How to avoid these errors with a tool like RocketFin

RocketFin helps you :

- Automatically score each file based on objective, traceable criteria

- Detect document inconsistencies as soon as they are received

- Tailor analysis to sector and business model

- Generate a customer transparency scorecard

- Save time while strengthening compliance

🏢 Case study: small business financing firm

Before RocketFin :

- 40% of files refused without clear justification

- Average analysis time: 48 hours

- Risk of customer requalification = high

After RocketFin integration :

- 70% automated analysis

- Justified, readable, exportable score

- Controlled acceptance rate without increasing risk

🎯 Result: +32% productivity and -20% scoring errors

📋 Robust analysis checklist for SME files

✅ Consistency between documents (Board of Directors, manager, share capital)

✅ Verification of legal status and active SIREN

✅ Actual cash flow and repayment capacity

✅ Detection of supplier/customer dependence

✅ Sectoral adaptation of ratios

✅ Archiving + decision justification

FAQ - SME financing analysis

Do I need an expert to analyze an SME case?

A well-configured tool can handle 70-80% of simple cases without a senior analyst. Borderline cases need to be escalated.

What if the company doesn't have a complete balance sheet?

You can analyze other signals: actual activity, articles of association, bank flows, payment behavior...

Can I reject a file automatically?

Yes, if the process is justified, documented and a human review is available on request.

🔗 Read more

👉 Automate the analysis of your SME files with RocketFin: www.rocketfin.ai

🟢 Request your preview access

Access form