KYC, LCB-FT, RGPD: how to automate compliance without losing efficiency

In an increasingly demanding regulatory environment, automating compliance processes is becoming a strategic issue for all B2B companies.

Between customer verification (KYC), anti-money laundering (LCB-FT) and compliance with the RGPD, fintechs and digital platforms must both protect themselves legally and preserve the fluidity of their customer acquisition.

But can we really automate compliance without degrading the user experience or mobilizing massive human resources?

Yes, thanks to an approach centered on data, business rules and decision-making AI.

⚖️ Why compliance has become critical for tech and financial companies

Whether you are :

- A B2B fintech that provides financing

- A SaaS platform with automated customer onboarding

- A regtech that processes regulatory data

You are concerned by at least three compliance aspects:

1. KYC - Know Your Customer

Check the legal identity of your customers (manager, company, beneficial owners)

2. LCB-FT - Combating money laundering and the financing of terrorism

Identify at-risk profiles, watch for weak signals (change of manager, dubious addresses, atypical legal forms, etc.).

3. RGPD - General Data Protection Regulation

Ensure fair, secure, justifiable and traceable collection of the data used in your flows.

🔄 The problem of manual processes

Old-fashioned compliance management is based on :

- Manual Pappers/Infograft extractions

- Spreadsheets to track validation of receipts

- Legal teams overworked to control every new customer

❌ Result:

- Incomplete files, forgotten checks

- Long onboarding time (2 to 5 days)

- Increased legal risks in the event of an audit or incident

🤖 How to automate compliance with AI and business rules

🚀 Step 1 - Automated collection of verified data

RocketFin connects to reliable, public sources:

- Insee, Infogreffe, Pappers (articles of association, SIREN, manager)

- European and international sanction registers

- Exclusion / vigilance files (PEP, watchlists)

- Document verification tools (OCR, ID-check)

Each company is automatically identified, verified and logged.

⚙️ Step 2 - Dynamic application of business rules

Based on the data collected, the engine applies :

- Vigilance scenarios by sector or country

- Rules on legal form, age of company, share capital

- Adjustable risk thresholds (e.g.: auto-entreprise + sales > €100K = alert)

💡 Example: a newly created company with a change of manager + commercial domiciliation triggers a "high risk" flag.

📊 Step 3 - Compliance scoring

Each file receives a RocketFin compliance score that is independent of the credit score.

This score combines :

- Consistency of legal data

- History of managers (presence in several structures, track record)

- Presence on watch lists

- Age and legal form

- Missing or inconsistent data

Un score ≥ 75/100 peut être validé automatiquement.

Un score < 50 déclenche un rejet ou une analyse approfondie.

🏢 Use case: a regulated B2B SaaS platform

Before RocketFin :

- Customer activation time: 72 hours on average

- 30% incomplete files

- 2 AMF inspections in 18 months

After automation :

- Onboarding in 15 minutes

- +45% complete validation from first shipment

- RGPD compliance + integrated traceability

🔐 And on the RGPD side: can we automate without legal risk?

Yes, as long as you respect 3 key principles:

-

Clear legal basis: customer verification is a legitimate obligation (legitimate interest or contractual obligation)

-

Relevant data only: collect only what is necessary for verification purposes

-

Traceability + human review: the customer must be able to understand an automated decision and request an appeal

🚨 AI must never be the sole arbiter of a refusal or block without a human call.

✅ Concrete benefits of RocketFin automation

| Profit | Impact |

|---|---|

| Instant KYC validation | Accelerated onboarding |

| Enhanced detection of at-risk profiles | Fewer legal incidents |

| Automatic logging | RGPD audit made easy |

| Real-time compliance score | An informed decision from the outset |

| API can be integrated without heavy dev | Rapid deployment |

📋 Best practices for automating your corporate compliance

- Modularize steps: legal data, compliance scoring, human validation

- Add specific business cases (e.g. high-risk activities, sensitive sectors, embargoed countries)

- Maintain a personalized white/black list (prohibited customers, non-compliant structures)

- Enable tracking over time: check the articles of association/Kbis/sanctions every 6 or 12 months

- Document each step with timestamp, user, source

🚫 Common mistakes to avoid

- Believing that a "pretty" PDF document is reliable

- Do not check the actual SIREN status

- Ignore recent changes of manager or address

- Leaving the end-user without a clear explanation in the event of a blockage

- Delete decision logs instead of archiving them (audit!)

FAQ - Automating regulatory compliance in B2B

Is it legal to automate compliance?

Yes, as long as the logic is documented, the data is not sensitive, and a human can intervene at any time.

Does the RGPD allow compliance scoring?

Yes, if it is not discriminatory profiling and the customer has a right of explanation and contestation.

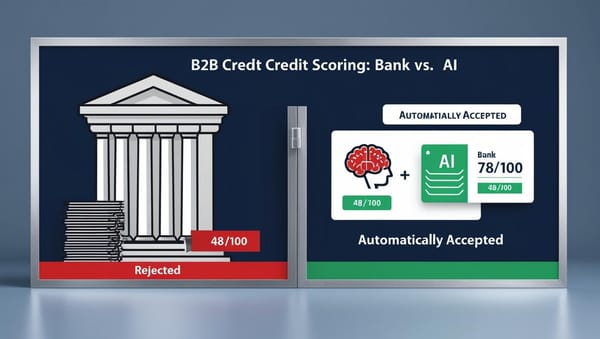

Can I use a single score for credit and compliance?

Not recommended. It's preferable to have a separate credit score and compliance score, but cross-referenced in the final decision.

Which tools do I need to connect?

Insee, Infogreffe, Pappers, sanction registers, identity verification, electronic signature tools.

🔗 Read more

👉 Find out how RocketFin enables you to automate KYC, LCB-FT and RGPD compliance without burdening your operations: www.rocketfin.ai

🟢 Request your RocketFin preview access

Access form