B2B fintechs: how to industrialize credit decision-making without a dedicated team

The digital financing market is changing fast. B2B fintechs need to make credit decisions quickly, reliably and within regulatory constraints.

But how do you score without recruiting an entire team of risk analysts?

The solution: industrialize your credit scoring via an automated engine, without losing precision or control.

In this article, we explain:

- Why automated scoring is key for fintechs

- How to put it into practice

- And how RocketFin accelerates your growth without sacrificing risk management

🚀 Why industrializing credit decisions is vital for fintechs

1. 💡 Volume vs human resources

You receive :

- 10 to 100 financing requests per day

- A wide range of profiles: VSEs, SMEs, SaaS, e-tailers

- Heterogeneous documents (balance sheets, invoices, banks, etc.)

But you don't have :

- 5 full-time credit analysts

- Tools integrated with your CRM

- Time to manually check each file

🎯 Industrialization means handling 80% of cases without human intervention, and concentrating resources on ambiguous cases.

2. ⚡ Customer expectations: immediate decision

In B2B as in B2C, your customers expect :

- Response within 24 hours

- A seamless, 100% digital experience

- A clear explanation in case of refusal

If your scoring still relies on an analyst, a spreadsheet and an email, you're losing leads every day.

3. ⚖️ Increasing regulatory constraints

Even in scale-up mode, you must :

- Complying with the RGPD

- Be able to explain an automatic decision

- Archive your checks

Well-designed automated scoring = time savings + legal certainty

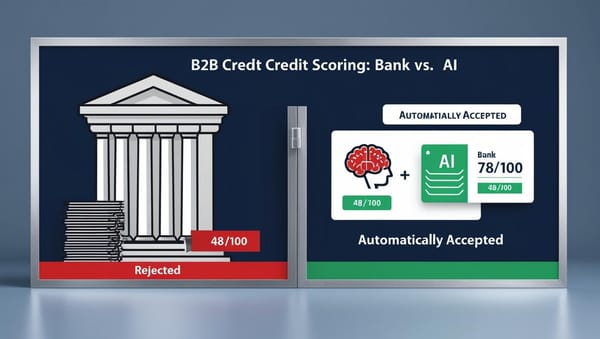

🔧 What an industrialized scoring engine is

It is a system capable of :

- Automatically collect data (financial, legal, behavioral)

- Apply dynamic business rules

- Calculate a contextualized risk score

- Trigger a decision (Accepted / Refused / To be validated)

- Archiving all stages of the decision

And this, without human intervention, for 70 to 90% of cases.

🧠 How RocketFin works

Step 1 - Flow integration

Connectors with :

- Insee / Infogreffe / Pappers

- Banking or ERP connectors

- Attachments (PDF balance sheets, income statements)

Step 2 - Score calculation

Based on :

- Financial analysis (margin, debt, cash flow)

- Legal stability (seniority, articles of association, SIREN)

- Behavioral data (lateness, invoice volume, activity frequency)

- Pre-trained AI models + your own rules

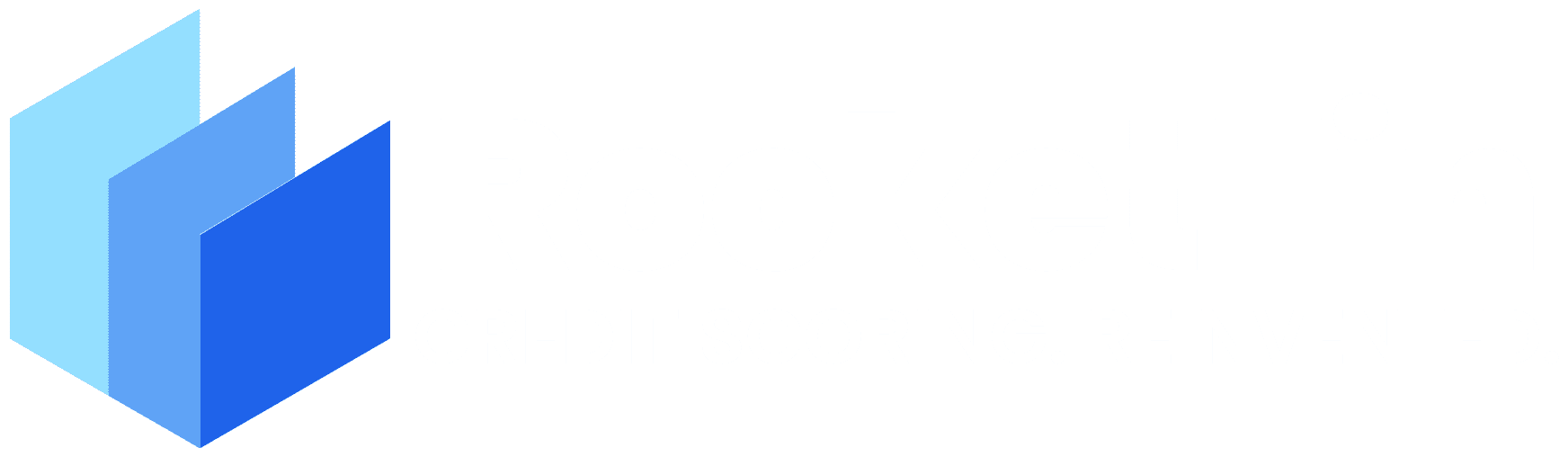

Step 3 - Decision-making

- Score > 70 → Accepted automatically

- Score < 50 → Refusé

- Between 50 and 70 or suspicion → "human validation" file

Each score is justified, exportable and time-stamped.

🏢 Case study: B2B fintech in pre-growth phase

Background :

- Short-term financing for SMEs

- 4 employees, no credit analyst

- 25 requests/day, expected to rise to 50/day

Before RocketFin :

- Files analyzed manually within 48 hours

- Acceptance rate: 40%.

- Refusals often unjustified

- Wobbly UX, loss of leads

After RocketFin :

- Automatic scoring on 80% of files

- Acceptation + décision en < 15 minutes

- 61% acceptance rate

- Better traceability of refusals = fewer disputes

🔥 Business impact: 2x more files processed without recruiting + improved customer NPS

🔁 Benefits at every stage of the cycle

| Step | Advantage with RocketFin |

|---|---|

| Pre-analysis | Detection of incomplete files in 5 seconds |

| Analysis | Automatic risk score calculation |

| Decision-making | Immediate acceptance or escalation |

| Compliance | Data archiving + full audit trail |

| Follow-up | Feedback loop to improve scores over time |

✅ What you can configure

- Your personalized scoring thresholds

- Your business rules by customer type

- Your feeds (API or manual interface)

- Your required documents and alert triggers

- Your internal exports / dashboards

You drive the business logic. RocketFin automates it at scale.

📋 Best practices for industrializing without losing relevance

- ⚖️ Always separate credit and compliance scores

- 🔍 Also score inter-document consistency

- 👩⚖️ Provide a filtered human validation system

- 💬 Include an explanation of the score in your customer emails

- 📁 Keep an audit trail of every automated decision

❌ 5 common mistakes fintechs make in the scale-up phase

- Using a spreadsheet as a scoring engine

- Apply the same rules to all sectors

- Failure to document rejects → disputes

- Thinking of AI as an uncontrolled black box

- Wait for "more volume" before industrializing

FAQ - Industrializing credit scoring in fintech

Is it really reliable without an analyst?

Yes, if the rules are well defined and the engine adapts to your business. 80% of cases can be handled without intervention.

Is it legal to automate a credit decision?

Yes, if the process is transparent and documented, and if a human can intervene in the event of a dispute.

Does RocketFin replace my risk team?

No, it saves you from having to recruit an entire team too early. You retain control, but automate the majority.

How long does it take to integrate RocketFin?

From a few hours to a few days, depending on your technical stack. The API is plug & play.

🔗 Read more

👉 Find out how RocketFin enables B2B fintechs to score without recruiting: www.rocketfin.ai

🟢 Request your preview access

Access form